Q1FY2020 Result Update | Banking

Jul 18, 2019

Yes Bank

NEUTRAL

CMP

`98.45

Provision remained elevated

Target Price

`-

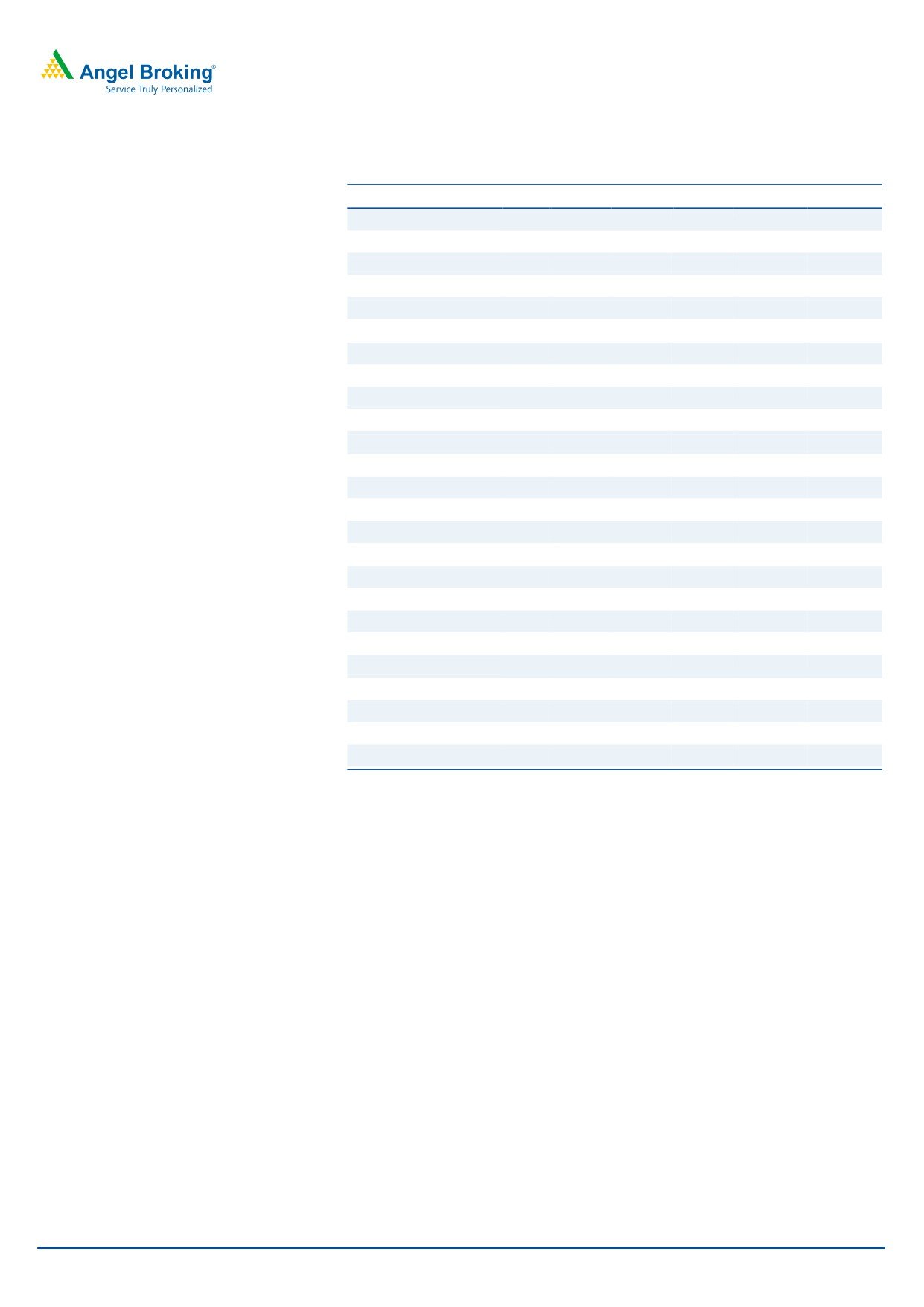

Particulars (` cr)

Q 1FY20

Q 4FY19

% chg (qoq)

Q 1FY19

% chg (yoy)

Investment Period

12 Months

NII

2,281

2,506

(9)

2,219

3

Pre-prov. profit

1,959

1,323

48

2,455

(20)

PAT

114

(1,507)

-

1,260

(91)

Stock Info

Source: Company, Angel Research

Sector

Banking

Yes Bank reported a poor set of numbers for Q1FY2020. Slippages for the quarter

were `6,232cr, up 51.5% qoq. This led to a jump in GNPA to 5.01%, up 179bps

Market Cap (` cr)

22,829

qoq and 370bpsyoy. Sharp jump of 230bps in BB & below book to `29,470cr was

Beta

1.2

a disappointment and will likely keep the provisions exp higher for next few

52 Week High / Low

404 / 85

quarters.

Avg. Daily Volume

80,08,078

Loan growth moderates; NIM compressed to 2.8%: Loan book growth moderated

to 10% yoy (declined 2% qoq), of which retail book increased by 44% yoy to

Face Value (`)

2

constitute 18% of total advances. NIM compressed by 21bps/28bps qoq/yoy to

BSE Sensex

39,216

2.8% on account higher NPA recognition and increase in COF. Henceforth

Nifty

11,687

advances growth will primarily depend on capital raising as banks CET-1 stands at

Reuters Code

YESB.BO

8.04%.

Slippages, provisions continue to remain elevated: During the quarter, slippages

Bloomberg Code

YES@IN

were `6,232cr of which `1,680cr were technical slippages, thus net slippages

came in at `4,552cr. These net slippages were from BB & below book, `2,500cr

were from watchlist identified (`10,000cr) in Q4FY19, which is subset of BB &

Shareholding Pattern (%)

below book. Higher slippages led to higher GNPA to 5.01% i.e. 179bps/370bps

jump over qoq/yoy. Bigger concern was a sharp jump of 230bps in BB & below

Promoters

19.8

book to 9.7% primarily led by a downgrade in Yes Bank’s investment in bonds of

MF / Banks / Indian Fls

21.6

two NBFC (exposure worth of `7,500 for which bank now caries provision of

`1,500cr (`1,109 MTM and `400cr writeback) which is 20%).During the quarter,

FII / NRIs / OCBs

36.2

bank took provisions worth `1,784cr, of which MTM was `1,109cr on bonds due

to downgrades. Remaining `675cr was for advance provision. However, total

Indian Public / Others

22.5

provision for advance is ~`2,000cr as bank used `1,399cr as specific provision

from `2,100cr contingent made for identified stress book. Management has

guided credit cost of 1.25% for FY20E, however, it does not include MTM of

Abs. (%)

3m

1yr

3yr

investment book.

Treasury gain, contained Opex supported pre-provision profit: NII increased 3%

Sensex

0.2

7.8

41.3

yoy (declined 10% qoq) led by higher interest income reversals of `220cr and

compression in spreads. During the quarter, bank treasury gain of `450cr and

Yes Bank

(61.4)

(74.3)

(58.1)

contained operating expense helped to report healthy 48% qoq jump in pre-pro

profit and (declined 20% yoy)

Outlook & Valuation: We have a neutral view on Yes Bank, considering (a) low

CET of 8.04%; for growth, the bank will have to raise capital at current valuations,

which is dilutive, (b) uncertainty related to BB & below book performance, (c) any

3-year price chart

fresh set of downgrade in investment/ advances will absorb CET-1 and will impact

500

growth. Hereon, the bank’s performance is more dependent on certain events viz.

400

resolution of some large exposure and capital raising, which is contingent.

300

200

Key financials (Standalone)

100

Y/E March (` cr)

F Y17

F Y18

F Y19E

F Y20E

F Y21E

0

NII

5,797

7,737

9,809

10,000

11,276

% chg

27

33

27

2

13

Net profit

3,330

4,225

1,720

1,325

2,798

% chg

31

27

(59)

(23)

111

Source: Company, Angel Research

NIM (%)

3.4

3.3

3.1

2.8

2.7

EPS ( Rs)

14

18

7

6

12

Jaikishan Parmar

P/E (x)

7

5

13

17

8

Research Analyst

P/ABV (x)

1.1

0.9

0.9

0.9

0.8

RoA (%)

1.8

1.6

0.5

0.3

0.6

022 - 39357600 Ext: 6810

R oE (%)

19

18

7

5

9

Source: Company, Angel Research, Note: CMP as of 17/07/19

Please refer to important disclosures at the end of this report

1

Yes Bank | Q1FY2020 Result Update

Exhibit 1: Q1FY2020 performance summary (standalone)

Particulars (` cr)

Q 3FY18

Q 4FY18

Q 1FY19

Q 2FY19

Q 3FY19

Q 4FY19

Q 1FY20

% chg (qoq)

% chg (yoy)

Interest Earne d

5,070

5,743

6,578

7,231

7,959

7,857

7,816

(1)

19

on Advances / Bills

3,846

4,404

5,005

5,550

6,248

6,120

6,106

(0)

22

on inve stments

1,098

1,179

1,351

1,561

1,604

1,533

1,539

0

14

on bal with RBI

82

110

162

58

42

136

104

(24)

(36)

on others

44

50

60

62

65

68

67

(1)

11

Interest Expended

3,182

3,589

4,359

4,814

5,293

5,351

5,535

3

27

Net Interest Income

1,889

2,154

2,219

2,418

2,666

2,506

2,281

(9)

3

Other Income

1,422

1,421

1,694

1,473

891

532

1,273

139

(25)

Retail Banking Fees

290

347

333

367

353

406

348

(14)

4

Corp Trade & cash

154

240

216

212

224

210

200

(5)

(8)

Corporate Banking Fees

243

644

683

668

472

(112)

61

(155)

(91)

Forex, DCM & Securities

723

178

460

222

(160)

11

656

5,865

43

Operating i ncome

3,311

3,575

3,913

3,891

3,557

3,038

3,554

17

(9)

Operating Expenses

1,309

1,440

1,459

1,525

1,567

1,714

1,594

(7)

9

Employee expe nse s

533

547

591

594

625

660

661

0

12

Other Opex

776

893

868

931

942

1,054

933

(12)

7

Pre Provision Profit

2,002

2,135

2,455

2,366

1,990

1,323

1,959

48

(20)

Provisions

421

400

626

940

550

3,662

1,784

(51)

185

PBT

1,580

1,736

1,829

1,427

1,440

(2,338)

175

(107)

(90)

Provision for Taxes

504

556

569

462

438

(832)

61

(107)

(89)

Tax rate

32

32

31

32

30

36

35

(2)

13

PAT

1,077

1,179

1,260

965

1,002

(1,507)

114

(108)

(91)

Balance sheet

Advance (` cr)

1,71,515

2,03,534

2,14,720

2,40,000

2,43,885

2,41,500

2,36,300

(2)

10

Deposit (` cr)

1,71,731

2,00,738

2,13,395

2,22,838

2,22,758

2,27,610

2,25,902

(1)

6

C/D Ratio (%)

1.00

1.01

1.01

1.08

1.09

1.06

1.05

(1.5)bp

4bp

CA (` cr)

22,604

28,826

28,333

25,941

29,538

28,500

24,800

(13)

(12)

SA (` cr)

42,685

44,351

46,598

49,339

44,579

46,753

44,300

(5)

(5)

CASA deposits (` cr)

65,289

73,176

74,930

75,279

74,117

75,253

69,100

(8)

(8)

CASA %

38

36

35

34

33

33

31

(247.4)bp

(452.5)bp

CAR (%)

20

18

17

16

17

17

16

(80)bp

(120)bp

Tier 1 CAR (%)

15

13

13

12

12

11

11

(60)bp

(210)bp

Source: Company, Angel Research

July 18, 2019

2

Yes Bank | Q1FY2020 Result Update

Exhibit 2: Profitability ratio remain compressed

Profitability Ratios (%)

Q 3FY18

Q 4FY18

Q 1FY19

Q 2FY19

Q 3FY19

Q 4FY19

Q 1FY20 % chg (qoq) % chg (yoy)

Cost of funds

5.9

5.7

6.1

6.2

6.5

6.4

6.7

26.4bp

54.5bp

Reported NIM

3.5

3.4

3.3

3.3

3.3

3.1

3

(30)bp

(50)bp

Cost-to-income ratio

39.5

40.3

37.3

39.2

44.0

56.4

45

(1156.5)bp

759.6bp

Asset quality

Gross NPAs (` cr)

2,974

2,626

2,824

3,866

5,158

7,882

12,092

Gross NPAs (%)

1.7

1.3

1.3

1.6

2.1

3.2

5.0

179bp

370bp

Net NPAs (` cr)

1,595

1,312

1,262

2,019

2,876

4,484

6,883

Net NPAs (%)

0.9

0.6

0.6

0.8

1.2

1.9

2.9

105bp

232bp

PCR (%)

46.4

50.0

55.3

47.8

44.2

43.1

43.1

(2.7)bp (1222.1)bp

Slippage ratio (%)

0.3

0.2

0.3

0.7

0.9

1.4

2.6

119.6bp

237.7bp

Credit Cost on Adv (Annl)

1.0

0.8

1.2

1.6

0.9

6.1

3.0

(304.5)bp

185.5bp

Exhibit 3: Asset Quality deteriorated led by higher slippages (Two NBFC Bond fall into BB & below book)

A sset Q uality

Q 2FY18 Q 3FY18 Q 4FY18 Q 1FY19 Q 2FY19 Q 3FY19 Q 4FY19 Q 1FY20

% qoq

% yoy

Gross NPA (` cr)

2,720

2,974

2,627

2,824

3,866

5,159

7,883

12,092

52.8

200.1

Net NPA (` cr)

1,543

1,595

1,313

1,263

2,019

2,876

4,485

6,883

55.9

241.6

Gross NPA %

1.82

1.72

1.28

1.31

1.60

2.10

3.22

5.01

179bp

370bp

Net NPA %

1.04

0.93

0.64

0.59

0.84

1.18

1.86

2.91

105bp

232bp

Provision Coverage%

43.3

46.4

50.0

55.3

47.78

44.24

43.11

43.08

(2.7)bp (1222.1)bp

Restructured Advances %

0.08

0.05

0.04

0.00

0.08

0.09

0.08

0.08

0bp

7.9bp

Security Receipt (Net) %

0.94

1.06

0.92

0.82

0.85

0.71

0.71

0.71

0bp

(11)bp

Standard SDR

0.32

0.21

-

-

0bp

0bp

5:25 Re financi ng

0.15

0.06

0.05

0.05

0bp

(5)bp

S4A/BBB

0.01

0.09

0.07

0.07

0bp

(7)bp

New Indentifieds Stressed asset

4.14

3.17

(96.7)bp

317.4bp

Total Stressed asset

2.54

2.40

1.72

1.53

1.77

1.98

6.79

6.87

8.3bp

534.3bp

Source: Company, Angel Research

Exhibit 4: Sequentially Corporate Rating Profile deteriorated

A dvance Rating (%)

Q 2FY18

Q 3FY18

Q 4FY18

Q 1FY19

Q 2FY19

Q 3FY19

Q 4FY19

Q 1FY20

% chg (qoq)

% chg (yoy)

AAA

19.7

22

23.2

22.2

21.3

21

22.3

20.5

(180)bp

(170)bp

AA

14.8

13.4

13.3

13.5

15.1

13.3

13.3

11.6

(170)bp

(190)bp

A

41

42.8

42.9

43.2

42.8

43

42.3

41.3

(100)bp

(190)bp

BBB

21.5

19

18.5

18.7

18.3

20.3

14.9

17.2

230bp

(150)bp

BB & B

2.9

2.8

2.2

2.3

2.4

2.5

7.1

9.4

230bp

710bp

Total

100

100

100.1

100

100

100

100

100

Source: Company, Angel Research

July 18, 2019

3

Yes Bank | Q1FY2020 Result Update

Income statement

Y/E March (` cr)

F Y17

F Y18

F Y19

F Y20E

F Y21E

Net Interest Income

5,797

7,737

9,809

10,000

11,276

- YoY Growth (%)

27

33

27

2

13

Other Income

4,157

5,224

4,590

3,840

4,361

- YoY Growth (%)

53

26

(12)

(16)

14

Operating Income

9,954

12,961

14,399

13,840

15,637

- YoY Growth (%)

37

30

11

(4)

13

Operating Expenses

4,117

5,213

6,264

7,263

8,351

- YoY Growth (%)

38

27

20

16

15

Pre - Provision Profit

5,838

7,748

8,135

6,576

7,287

- YoY Growth (%)

36

33

5

(19)

11

Prov. & Cont.

793

1,554

5,778

4,598

3,111

- YoY Growth (%)

48

96

272

(20)

(32)

Profit Before Tax

5,044

6,194

2,357

1,978

4,176

- YoY Growth (%)

34

23

(62)

(16)

111

Prov. for Taxation

1,714

1,970

637

653

1,378

- as a % of PBT

34

32

27

33

33

PAT

3,330

4,225

1,720

1,325

2,798

- YoY Growth (%)

31

27

(59.28)

(23)

111

Balance sheet

Y/E March (` cr)

F Y17

F Y18

F Y19

F Y20E

F Y21E

Equity

456

461

463

463

463

Reserve & Surplus

21,598

25,298

26,441

27,700

30,358

Net worth

22,054

25,758

26,904

28,163

30,821

Deposits

1,42,874

2,00,738

2,27,610

2,61,467

3,01,762

- Growth (%)

28

41

13

15

15

Borrowings

38,607

74,894

1,08,424

1,20,351

1,37,200

Other Liab. & Prov.

11,525

11,056

17,888

15,635

18,670

Total Liabilities

2,15,060

3,12,446

3,80,826

4,25,615

4,88,454

Cash Balance s

6,952

11,426

10,798

15,895

18,305

Bank Balances

12,597

13,309

16,092

18,340

21,121

Investments

50,032

68,399

89,522

95,370

1,09,830

A dvances

1,32,263

2,03,534

2,41,500

2,70,480

3,11,051

- Growth (%)

35

54

19

12

15

Fixed Assets

684

832

817

1,223

1,408

Other Assets

12,532

14,946

22,098

24,308

26,739

Total Assets

2,15,060

3,12,446

3,80,826

4,25,615

4,88,454

- Growth (%)

30

45

22

12

15

July 18, 2019

4

Yes Bank | Q1FY2020 Result Update

Ratio analysis

Y/E March (` cr)

F Y16

F Y17

F Y18

F Y19

F Y20E

F Y21E

Profitability ratios (%)

NIMs

3.3

3.4

3.3

3.1

2.8

2.7

Cost to Income Rati o

40.9

41.4

40.2

43.5

52.5

53.4

RoA

1.7

1.8

1.6

0.5

0.3

0.6

RoE

19.9

18.6

17.7

6.5

4.8

9.5

B/S ratios (%)

CASA Ratio

0.28

0.36

0.36

0.33

0.33

0.33

Credit/Deposit Ratio

0.9

0.9

1.0

1.1

1.0

1.0

A sset Q uality (%)

Gross NPAs

0.76

1.52

1.28

3.22

4.50

3.50

Gross NPAs (` cr)

749

2,019

2,627

7,883

12,172

10,887

Net NPAs

0.29

0.81

0.64

1.86

2.30

1.50

Net NPAs (` cr)

284

1,072

1,313

4,485

6,221

4,666

Credit Cost on Advance

0.55

0.60

0.76

2.39

1.70

1.00

Provision Coverage

62%

47%

50%

43%

49%

57%

Per Share Data (`)

EPS

11.0

14.5

18.3

7.5

5.8

12.1

BV

59.9

95.8

111.8

116.8

122.3

133.8

ABVPS (75% cover.)

59.6

93.7

109.6

107.6

111.1

127.8

DPS

2.0

2.4

2.7

1.3

0.3

0.6

Valuati on Ratios

PER (x)

8.9

6.8

5.4

13.2

17.1

8.1

P/BV

1.6

1.0

0.9

0.8

0.81

0.74

P/ABVPS (x)

1.7

1.1

0.9

0.9

0.89

0.77

Dividend Yield

2.0

2.4

2.7

1.4

0.3

0.6

Note - Valuation done on closing price of 17/07/2019

July 18, 2019

5

Yes Bank | Q1FY2020 Result Update

Research Team Tel: 022 - 39357800

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an inv estment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other rel iable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any wa y

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cann ot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may ari se from or in

connection with the use of this information.

Disclosure of Interest Statement

Yes Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

July 18, 2019

6